Top 14 Best AI Tools for Developers in 2026

Nova Hawthrone

November 26, 2025

Finance AI is revolutionizing the finance industry exceptionally and making everything smarter than ever before. The AI allows us to fulfill tasks like data entry and report generation, which used to take a lot of time, and can now be automated with AI tools. This frees up finance professionals to focus on more important things, such as planning for the future, managing risks, and advising clients.

Many finance departments now use AI, showing its potential is widely recognized. By using AI tools for finance, teams can make better decisions, improve the accuracy of their work, and stay ahead of the competition.

In this article, we will explore the top AI tools for financial management so that you can use them to enhance your productivity. So, let’s start our discussion.

Before starting to explore the top AI-powered finance tools, yuo must know about what these tools are. AI finance tools are software applications that use artificial intelligence to streamline financial processes. By employing machine learning and other AI techniques, these tools automate tasks, analyze data, and provide acumen to improve financial decision-making.

Artificial intelligence (AI) is transforming the finance industry. AI excels at analyzing vast datasets much quicker than humans, enabling us to understand market trends better, identify potential risks, and make more informed decisions.

Furthermore, AI automates numerous tasks, such as processing loan applications or detecting fraudulent activity, leading to increased efficiency and cost savings for businesses.

In finance, AI-powered tools can automate business processes, minimizing errors and providing valuable insights. This leads to cost savings, improved decision-making, enhanced risk management, and a better customer experience.

Ultimately, AI empowers financial institutions to operate more efficiently, gain a competitive edge, and deliver superior value to their clients. Let’s explore some key benefits of AI Tools in Finance.

AI automates mundane tasks like data entry and report generation, freeing up finance professionals for more strategic work. This increases efficiency and reduces the risk of human error.

AI analyzes vast datasets to identify patterns and forecast future trends. This empowers financial professionals to make more informed decisions, such as investment strategies and risk management plans.

AI can detect anomalies and identify potential risks like fraud or money laundering, helping financial institutions comply with regulations and minimize losses.

AI tools can analyze historical data and market trends to create more accurate financial forecasts and budgets. This allows for better resource allocation and improved financial performance.

AI-powered chatbots and virtual assistants provide instant customer support, answer frequently asked questions, and personalize customer interactions.

AI algorithms can analyze market data, assess risk, and optimize investment portfolios based on individual investor goals and risk tolerance.

AI implementation in finance faces challenges. Data quality and security are paramount, as AI models rely on accurate and reliable data. Complex financial regulations and the need for explainable AI decisions pose hurdles. Mitigating bias in AI algorithms and addressing ethical concerns related to data privacy and fairness are crucial for responsible AI adoption in the financial sector.

AI systems in finance are vulnerable to cyberattacks, compromising sensitive financial data and disrupting critical operations. Robust security measures, including strong encryption and access controls, are crucial to protect against data breaches and maintain customer trust.

AI models can inherit biases present in their training data, leading to discriminatory outcomes in lending, investment, and other financial decisions. Mitigating bias requires careful data selection, rigorous testing, and ongoing monitoring of AI systems to ensure fairness and equity.

AI excels at automating tasks and analyzing data, but human oversight is crucial in financial decision-making. Finding the right balance between AI automation and human expertise is key for responsible AI use in finance.

Implementing and maintaining AI systems requires significant investments in technology, data infrastructure, and skilled personnel. Financial institutions must carefully assess AI initiatives' costs and potential returns to ensure a positive return on investment.

We've discussed how AI is transforming the financial landscape by automating tasks, improving decision-making, and enhancing customer experiences. We've also touched on the benefits and challenges of AI implementation in finance, including cybersecurity risks, algorithmic bias, and the need for human oversight.

Now, we'll explore some of the top AI tools currently available that finance professionals can use it to streamline their workflows and gain a competitive edge. These tools offer a range of capabilities, from predictive analytics and risk management to fraud detection and personalized financial advice.

Several prominent AI-powered platforms, such as Datarails FP&A Genius, Planful Predict, HighRadius, and others, are transforming financial planning and analysis (FP&A). By leveraging machine learning, these tools automate data analysis, generate predictive insights, and streamline forecasting processes, empowering finance teams to make more informed and data-driven decisions.

Cube, an FP&A platform, empowers finance teams by streamlining their planning and analysis processes. It seamlessly integrates data from diverse sources, providing a unified view of financial and operational information. Cube automates model building, enhancing efficiency. Users can easily access and edit data within their preferred environment.

Furthermore, Cube incorporates AI-powered features like predictive forecasting and benchmarking, providing acumen for informed decision-making and improved strategic planning.

Features:

Ratings on G2:

Who is best for using Cube?

Cube is particularly well-suited for finance teams who heavily rely on Excel and Google Sheets for their daily work, and who are looking to streamline their financial planning and analysis processes while maintaining the familiarity of their existing productivity.

Datarails FP&A Genius is an AI-powered chatbot that empowers finance professionals to streamline financial analysis for professionals. By leveraging real-time company data, it provides quick and accurate answers to complex financial questions.

Within your familiar workflow, you can easily generate reports and create insightful visualizations. This powerful AI tool significantly enhances the efficiency and accuracy of your financial analysis and reporting.

Features:

Ratings on G2:

Who is Best For Using Datarails?

Datarails is ideal for finance teams who rely on Excel and need to streamline their FP&A processes. It integrates data, automates tasks, and provides deeper financial insights.

Planful Predict, an AI-powered tool, enhances financial forecasting by analyzing both structured and unstructured data to predict future outcomes. This empowers businesses with more informed budgetary and planning decisions. By automating data collection and analysis, Planful Predict saves time and effort for finance teams.

Furthermore, it enables what-if scenario exploration to assess the financial impact of different decisions. While it can be expensive, Planful Predict significantly improves the accuracy of financial forecasts.

Features:

Ratings on G2:

Who is Best For Using Planful?

Planful is best suited for finance teams within organizations of all sizes, including those in finance, accounting, and operations, who seek to improve their budgeting, forecasting, and financial planning processes through automation, data-driven insights, and enhanced collaboration.

Vena is well-suited for finance teams that rely heavily on Excel to perform various financial tasks. It uses artificial intelligence (AI) to analyze data and spot trends. This allows companies to improve their budgeting, forecasting, and overall financial performance.

With Vena Insights, teams can create customized dashboards, identify potential problems early on, and make more accurate predictions. This leads to more efficient operations and stronger financial results.

Features:

Ratings on G2:

Who is Best For Using Vena?

Vena is best suited for finance teams within mid-sized companies that heavily rely on Excel for their work. It's ideal for those looking to streamline their budgeting, forecasting, and reporting processes while still working within a familiar Excel-like environment.

AI tools for accounting and compliance use artificial intelligence to automate tasks like data entry, invoice processing, tax calculations, and regulatory reporting. These tools can identify and flag potential discrepancies, reduce human error, and improve overall efficiency and accuracy in financial operations while ensuring adherence to relevant regulations.

Trullion, an AI-powered financial analysis tool, streamlines accounting workflows. It consolidates diverse financial data, ranging from organized spreadsheets to unstructured contracts, into a user-friendly platform.

By streamlining operations and enabling more sophisticated data analysis, Trullion helps companies save costs, ensures compliance with the latest accounting rules, and allows accountants to focus on higher-value tasks instead of tedious paperwork.

Features:

Ratings on G2:

Who is Best For Use Trullion?

Trullion is best suited for businesses with complex financial needs, particularly those with a significant number of leases, a strong focus on compliance, and a desire to streamline their accounting processes.

Vic AI uses AI to streamline accounts payable (AP) tasks, freeing up your accounting team for strategic work. It automates repetitive tasks like invoice processing and approval workflows, allowing your team to focus on analyzing complex financial data and generating accurate financial reports.

Vic AI's high accuracy reduces errors and improves cash flow, while its financial insights empower you to make informed financial decisions.

Features:

Ratings on G2:

Who is Best For Using Vic AI?

Vic AI targets businesses struggling with manual AP tasks within their accounting software. It automates AP processes for faster invoice processing and reduces errors, freeing your team to focus on financial reporting and analysis.

HighRadius, a leading fintech company, offers an AI-powered platform for CFOs. It automates core financial processes, including order-to-cash, accounts payable, and treasury management, helping businesses improve cash flow and productivity. HighRadius serves thousands of enterprises globally, processing trillions of transactions, and is committed to innovation and customer success within the financial institutions landscape.

Features:

Ratings on G2:

Who is Best For Using HighRadius?

HighRadius is best suited for mid-sized to large enterprises with complex financial operations seeking to automate and optimize their order-to-cash, accounts payable, and treasury processes.

Workiva, a cloud-based platform, simplifies complex financial reporting, compliance management, and ESG reporting. It connects data and teams, uses generative AI to automate processes, and ensures accurate financial reporting. Key features include collaboration, version control, and AI capabilities, improving efficiency and transparency when working with financial documents.

Features:

Ratings on G2:

Who is Best For Useing Workiva?

Workiva is ideal for larger companies, especially public ones, that need strong financial, compliance, and ESG reporting. It helps teams manage complicated reports and keep data accurate and consistent.

NetSuite is a leading cloud-based suite of existing ERP systems, financials, CRM, and e-commerce. It provides a single platform to manage core business processes, offering real-time visibility and data-driven decision-making in the finance world. It utilizes business intelligence to analyze market trends and empower businesses to make informed decisions. Its cloud delivery reduces IT costs, and its scalability suits growing businesses.

Features:

Ratings on G2:

Who is Best For Using NetSuite?

NetSuite is ideal for growing businesses needing a unified cloud platform for financials, CRM, and e-commerce, streamlining operations and scaling efficiently.

AI tools for market intelligence and stock analysis empower investors with data-driven insights. By analyzing vast amounts of data, these tools identify trends, predict market movements, and assess risk.

These tools automate complex analysis and extract data to generate insights that would be difficult or time-consuming for humans to find, supporting more accurate financial reporting and informed investment decisions.

AlphaSense empowers professionals in financial markets and assists professionals in making informed financial decisions, including financial records, by analyzing both structured and unstructured data from diverse sources.

These sources include multiple data sources, research reports, news, and expert opinions, AlphaSense facilitates the extraction of valuable insights into companies, industries, and markets. These insights can be crucial for revenue recognition, financial decision-making, and overall business success.

Features:

Ratings on G2:

Who is Best For Using AlphaSense?

AlphaSense is best for professionals needing deep market intelligence, such as financial analysts, researchers, and strategists. It's ideal for those who need to quickly analyze large amounts of information from diverse sources to make informed decisions through the use of advanced analytics.

Kensho, S&P Global's AI and Innovation Hub, develops cutting-edge AI and machine learning solutions that transform unstructured data, like text and speech, into actionable business insights.

They empower organizations to make data-driven decisions by structuring and enriching information from diverse sources.

Features:

Ratings on G2:

Who is Best For Useing Kensho?

Kensho is ideal for organizations in finance and related fields needing to extract insights from large volumes of unstructured data using AI for better decisions and efficiency.

Numerai is a hedge fund that uses crowdsourced AI models to generate trading signals, leveraging a global community of data scientists who build predictive models on anonymized financial data. It combines these models with AI algorithms to create and execute trading strategies.

Features:

Ratings on G2:

Who is Best For Using Numerai?

Numerai is best for data scientists and hedge funds who want to contribute to and benefit from a unique, crowd-sourced approach to AI-driven trading.

AI tools for document and workflow automation streamline business processes by automating tasks like data extraction, document processing, and workflow approvals. This enhances efficiency, reduces manual effort, and improves cash flow management by seamlessly integrating with existing financial systems. Let's explore these AI tools together.

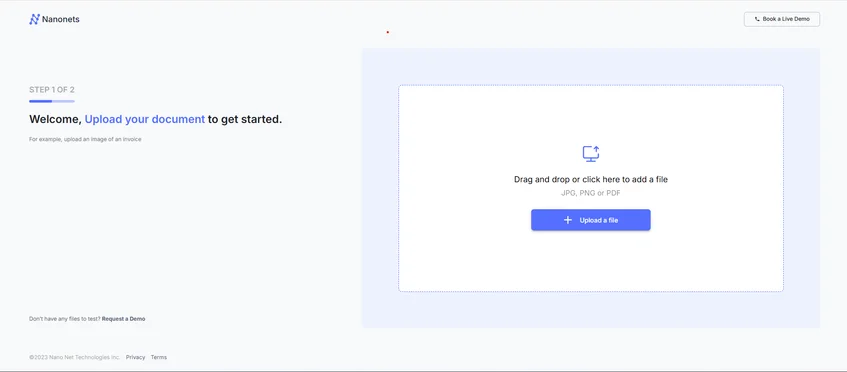

Nanonets, an AI-powered platform, acts as a data entry automation hub for businesses. It automates manual data entry by extracting information directly from documents, including invoice processing and lease accounting.

By extracting data from documents, Nanonets saves time and reduces errors, allowing finance teams to focus on more strategic tasks.

Features:

Ratings on G2:

Who is Best For Using Nanonets?

Nanonets is best for businesses that handle large volumes of documents and need to automate tasks like invoice processing, data entry, and document analysis.

Stampli is an AI-powered platform that helps businesses automate their accounts payable processes. It extracts data from invoices, streamlines approvals, and integrates with accounting software, saving time and reducing errors.

Features:

Ratings on G2:

Who is Best For Using Stampli?

Stampli is best for finance teams, especially those in accounts payable, who want to automate invoice processing, improve efficiency, and gain better control over their finances.

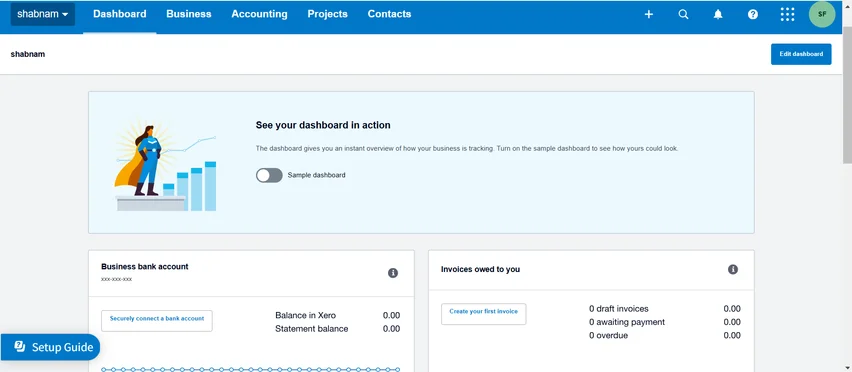

Xero is a cloud-based accounting software that helps small businesses streamline their accounting tasks, improve efficiency within their accounting systems, and gain valuable insights through features like bank reconciliations, invoicing, and real-time financial reporting. Improved financial visibility allows businesses to make more informed decisions.

Features:

Ratings on G2:

Who is Best For Using Xero?

Xero is best for small and medium-sized businesses looking for user-friendly, cloud-based accounting software to manage their finances, automate tasks, and gain valuable insights.

In this section of our discussion on top AI tools for finance, we will cover those AI tools that help you in client engagement and advisory. So, let’s explore them!

ChatGPT is an advanced AI chatbot developed by OpenAI. It can be effectively used for client communication and generate human-like text in response to a wide range of prompts and questions. This includes answering questions, generating creative content, translating languages, and writing different kinds of creative content.

Features:

Ratings on G2:

Who is Best For Using ChatGPT?

ChatGPT is best for anyone who needs help with tasks involving languages, such as students, writers, researchers, and anyone curious to explore the potential of AI.

Booke AI is an accounting helper that uses clever automation to take care of boring bookkeeping tasks. It can automatically sort your transactions, fix errors, and even pull data from receipts in a snap. Booke AI also offers plans for different needs, with a basic option for simple automation and a more advanced plan with powerful AI features.

Features:

Ratings on Trustpilot:

Who is Best For Using Booke AI?

Booke AI is best for bookkeepers, accountants, and businesses of all sizes who want to automate bookkeeping tasks, improve accuracy, and collaborate easily with clients.

Betterment is an automated investment platform that helps individuals grow their money. It uses AI and algorithms to build and manage diversified investment portfolios based on your financial goals and risk tolerance.

Features:

Ratings on G2:

Who is Best For Using Betterment?

Betterment is best for individuals who want to invest their money but prefer a hands-off approach, seeking automated portfolio management and low-cost investing options.

Till now, we have covered the most popular AI tools for financial management. Now, we will discuss some less popular yet productive AI tools that will enhance your workflows exceptionally.

Sage Intacct is a leading cloud-based accounting and financial management software. It helps businesses streamline their financial operations by automating tasks like accounts payable, accounts receivable, and general ledger processes.

In addition, with features like real-time reporting, robust integrations, and industry-specific solutions, Sage Intacct empowers businesses to make data-driven decisions, improve efficiency, and gain a competitive edge.

Domo is another business intelligence platform that helps companies make better decisions by connecting data from different sources, creating interactive dashboards, and using AI to find insights. It helps businesses work more efficiently and gain a competitive advantage.

The advancements in artificial intelligence are making everything smarter and more efficient than ever before. Companies use AI for tasks like fraud detection, risk assessment, and algorithmic trading. AI algorithms can analyze vast datasets to identify patterns and anomalies, enabling faster and more accurate decision-making in areas like loan approvals, investment strategies, and market predictions.

AI is already impacting finance significantly. For instance, chatbots are handling customer inquiries in banks, robo-advisors are managing investment portfolios, and AI-powered systems are detecting and preventing fraudulent transactions, improving efficiency and enhancing the customer experience across the financial sector.

When we come to talk about choosing the right AI tools for finance, there are a few elements you need to take care of. For example, carefully consider your specific financial goals and challenges, then evaluate AI tools based on their capabilities, data security features, ease of use, and cost-effectiveness.

Here are some must-have checkpoints before choosing an AI tool.

The second attribute after pricing is the features an AI tool contains. Here is a list of some must-have features you should check before choosing an AI tool for your financial needs.

Last but not least, check the integration capabilities of an AI tool. Using AI tools in business operations can significantly enhance your efficiency and productivity. This approach enhances decision-making and opens new growth opportunities.

The future of AI in finance promises a landscape of hyper-personalized services, predictive analytics, and automated processes, all while prioritizing ethical considerations and responsible innovation.

Expect to see advancements in areas like explainable AI, decentralized finance (DeFi) powered by AI, and the rise of AI-driven personalized financial services.

Ensuring fairness, transparency, and accountability in AI applications is crucial for building trust and promoting ethical growth within the financial sector.

At the end of our discussion on AI tools for Finance, we can say that using AI in finance is no longer optional but a necessity. By using its power for tasks like fraud detection, risk management, and personalized customer experiences, financial institutions can gain a significant competitive advantage.

This requires responsible AI development and implementation, ensuring ethical and trustworthy outcomes for both businesses and their customers. The team of AIChief researchers has gone through every AI tool responsibly and crafted this article for you. So, read this guide, find the best AI tool for financial management, and make yourself more productive!

Top AI tools for finance in 2025 include those that automate tasks, provide data-driven insights, and improve decision-making. Examples include tools for financial forecasting, risk management, fraud detection, and customer service.

While AI can automate many tasks currently performed by financial analysts, it cannot fully replace them. Human judgment, critical thinking, and the ability to understand complex market nuances are still essential for successful financial analysis.

AI tools that can help small businesses improve efficiency and productivity are particularly valuable. These include tools for customer service, marketing, sales, and operations. Examples include chatbots, social media management tools, and project management software with AI capabilities.